Assessing impact of merchant banking on Nigeria’s economy

Merchant banks play a very essential role in the provision of long-term funding to companies. The uniqueness of merchant banking lies in providing long-term public funds to small scale businesses through Initial Public Offering (IPO). In addition to funding businesses, merchant banks carry out wealth and asset management services, equity underwriting, credit syndication etc.

The merchant banking services in Nigeria was reintroduced in 2010 (after the sweeping reforms in 2008 by Central Bank) through the new banking model i.e. the repeal of the universal banking regime to provide solutions and financial options to reduce some of the challenges affecting the country’s economic growth to its minimum level.

With the volatile conditions facing Nigeria’s economy as demonstrated through exchange rate, inflation, interest rates volatility, as well as over-dependence on oil and obsolete infrastructure, the country has experienced gross unemployment, slow growth and development. In order to surmount these challenging issues, the need to sustain the growth of corporations and individuals through long-term strategy and financial options becomes pertinent.

Merchant banking in pre-consolidation and post-consolidation periods

Merchant banks were established to provide services consisting of advisory and investment-related services, majorly in form of equity stakes and subordinated facilities for companies and trade finance. This segment provides corporate investments, corporate loans, portfolio management, loan syndication, bond financing, and merger and acquisitions advisory to even real estate investment as well as trade finance.

“Since the return of the merchant bank in Nigeria, the system has undoubtedly, in spite of critics, made tremendous contributions to the general development of Nigeria’s economy; particularly to the development of the country’s financial environment and has increased the size of financial claims in issues and helped broaden the country’s financial infrastructure,” according to research by Rand Merchant Bank, one of the leading merchant banks in Nigeria.

“The ‘second coming’, as it were, of merchant banks has no doubt opened opportunities for increased investments and trade facilitation – roles that have been hitherto left to only commercial banks. We dare to say that merchant banking system remains the livewire through which the Nigerian economy grows,” RMB added.

In Nigeria, there are only five licensed merchant banks as against 24 commercial banks and over 30 primary mortgage institutions according to the Central Bank of Nigeria (CBN). Considering this discrepancy and size of small scale businesses in Nigeria, we can say that there are huge amount of unutilized opportunities in the industry.

Facts and figures

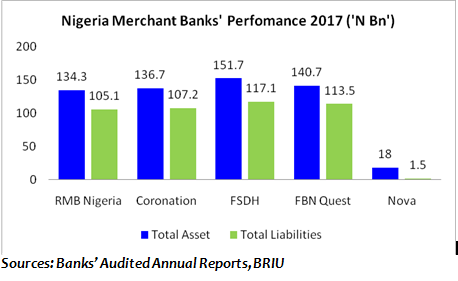

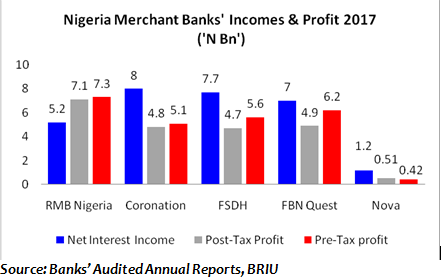

From 2012 to date, merchant banking licenses have been issued to Coronation Merchant bank, FSDH Merchant Bank, Rand Merchant Bank Nigeria, FBN Quest Merchant Bank and Nova Merchant Bank. The 2017 data gathered from various banks’ audited annual report show that the Nigerian merchant banking industry recorded a total asset of N581.4 billion, total liabilities worth N444.4 billion, and N29.1 net interest income. In terms of cash and bank balances, the industry recorded N49.2 billion. The industry also made a pre-tax profit of N24.6 billion, post-tax profit of N22 billion; recorded N239.4 billion deposits from customers and N152.3 billion loans to customer in 2017.

Leading the industry in terms of total assets is FSDH Merchant Bank with N151.7 billion followed by FBN Quest with total assets of N140.7 billion. Coronation Merchant Bank had N136.7 billion; Rand Merchant Bank with N134.3 billion while Nova Merchant Bank, the newest firm in the industry, reported total asset worth N18 billion in eight months.

FSDH reported N117.1 billion total liabilities for the 2017 financial year; FBN Quest recorded N113.5 billion, Coronation, N107.2 billion; RMB, N105.1 billion and Nova with N1.5 billion.

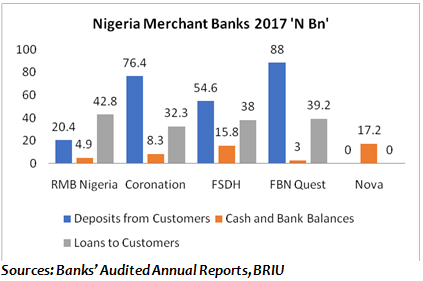

In terms of deposits from customers, FBN Quest tops the other banks in the Nigerian merchant banking industry with deposits worth N88 billion. Coronation Merchant Bank followed with N76.4 billion, FSDH with N54.6 billion, and RMB Nigeria, N20.4 billion.

Net interest income and loans to customers vary across the 5 merchant banks in Nigeria. RMB Nigeria recorded N5.2 billion net interest income and N42.8 billion loans to customers in 2017. Coronation Bank reported N8 billion and N32.3 billion while FSDH reported N7.7 billion and N38 billion. In addition, FBN Quest reported N7 billion and N39.2 billion net interest income and loans to customers respectively. Nova reported N1.2 billion net interest income but had no record on its loans to customers.

Pre-tax profit of RMB Nigeria is highest in the industry. The bank accrued a pre-tax profit of N7.3 billion in 2017. FBN Quest and FSDH recorded PBT of N6.2 billion and N5.6 billion respectively. Coronation on the other hand amassed N5.1billion while Nova’s PBT is N0.42 billion.

Merchant banking impact on the economy

In discussing how the industry has impacted the Nigerian economy, it is obvious that the merchant banking system has broaden the country’s economic base and reduced its reliance on crude oil for revenues.

Therefore, the emergence of merchant banks in Nigeria reflects the changing structure of the economy due to the increasing need for specialized and sophisticated banking services from various corporate institutions with a view to positioning their respective businesses within their chosen sectors and also paving the way for economic diversification.

In the last 5 years of operations, several landmark transactions have been successfully executed by merchant banks in Nigeria, of which the notable deals executed are in alignment with the Federal Government’s growth plan.