Good corporate governance, a key pillar to sustainability

Following high-profile cases of bankruptcy in large corporations, and the financial crisis of the late 2000s, interest in corporate governance practices of modern corporations has increased, particularly as it relates to accountability. It is no news that corporate failures in Nigeria have been increasing as a result of poor corporate governance.

According to Investopedia, “Corporate governance is the system of rules, practices and processes by which a company is directed and controlled. It involves balancing the interests of a company’s many stakeholders, such as shareholders, management, customers, suppliers, financiers, government and the community.”

Therefore, in order to address the incidence of corporate failures, moderate the conflict of interest between managers and shareholders, as well as ensure efficient and effective use of corporate assets for the interest of investors and other stakeholders, regulators across the globe have evolved measures to enthrone good corporate governance in organisations. These measures, often captured in the ‘Code of Corporate Governance’ of various institutions, constitute the parameters upon which companies can be evaluated by analysts and investors for the purpose of determining their overall health.

In Nigeria, the Securities and Exchange Commission (SEC) and Central Bank of Nigeria (CBN) have come up with Codes of Corporate Governance that will enable them monitor the actions, policies, practices and decisions of corporations, their agents and stakeholders so as to ensure absolute compliance with good corporate governance, especially in the financial sector.

What are the codes of corporate governance?

Considering the need for standardisation in the practice of corporate governance in the Nigerian financial sector, the Central Bank of Nigeria (CBN) has established some basic principles of good corporate governance and set out a code of best practices called the “Code of Corporate Governance”. Some of the content of this code include the following:

“The size of the board of any bank shall be limited to a minimum of five (5) and a maximum of twenty (20) and shall consist of Executive and Non-Executive Directors with higher number of Non-Executive Directors than Executive Directors.”

Also, “The board of banks shall have at least two (2) Non-Executive Directors as Independent Directors and a committee responsible for the oversight of risk management and audit functions.” These functions, it notes, may be carried out by one committee, particularly in small institutions.

Furthermore, the board shall meet at least once a quarter to effectively perform its functions. Hence, every director is required to attend all the meetings of the board, the board committees and must have attended at least two-thirds of all board and board committees’ meetings in order to qualify for re-election.

How will the code of corporate governance benefit institutions and shareholders?

Analysts have identified strict adherence to the code of corporate governance as one of the key pillars of corporate sustainability and urge Nigerian organisations to adopt these measures for the growth and efficiency in their organisations.

“Individually, it makes the stakeholders better people as they imbibe good practice of accountability and transparency”, Femi Ademola, a senior analyst said.

Human resource specialist according to him will say “recruit for attitude and train for skills”, which in other words means that organisations can train the employees for skills but with the wrong attitude, they can pull the company down. Hence, he sees corporate governance as the attitude of a company.

Furthermore, it helps moderate conflict of interest and earns organisations trust from customers as well as builds their brand authenticity. Good corporate governance enhances investors’ confidence in corporate organisations paving the way for easy generation of capital due to high level of trust the investing community have in them.

How compliant are Nigerian banks to the Code of Corporate Governance?

BusinessDay Research and Intelligence Unit (BRIU), the research arm of BusinessDay analysed data from the banks’ 2016 audited financial reports. Our analysis shows a considerable level of compliance of banks to the Code of Corporate Governance.

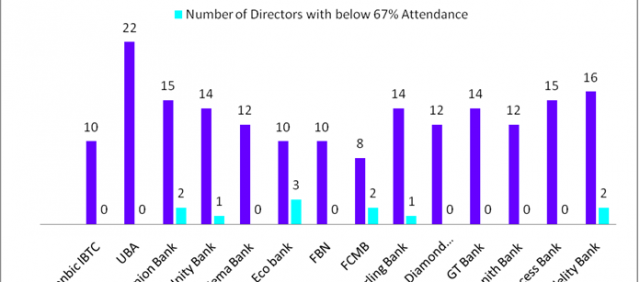

However, for the individual board meeting attendance, only the directors of Stanbic IBTC, United Bank for Africa (UBA), Wema Bank, First Bank, Diamond Bank, Guaranty Trust Bank (GTB), Zenith Bank and Access Bank met the minimum 67 per cent board meeting attendance; the other banks had at least one of their directors that did not meet this requirement.

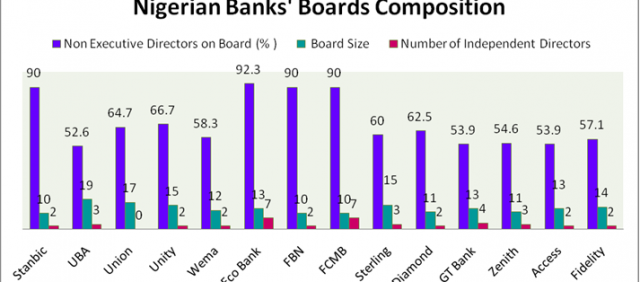

As to the size of board, Stanbic IBTC Holdings Plc board comprised 10 members; United Bank for Africa Plc (UBA) had 19 board members, while Union Bank of Nigeria Plc had 17 board members. Similarly, Unity Bank Plc and Sterling Bank Plc had 15 board members each; Wema Bank Plc had 12 board members; Ecobank Plc had 13 board members. FBN Holdings Plc and FCMB Group Plc each had 10 board members.

Whereas, Diamond Bank Plc and Zenith Bank plc had 11 board members each, Guaranty Trust Bank Plc and Access Bank Plc each had 13 board members, while Fidelity Bank Plc had 14 board members.

Source: Banks’ Financial Report 2016, BRIU

Furthermore, our findings show that Ecobank’s non-executive directors comprised 92.31 per cent of its total board size even as seven of these non-executive directors were independent directors. Stanbic IBTC Bank, FBN and FCMB had 90 per cent non-executive directors on their boards, with two of the directors each for Stanbic IBTC Bank and FBN as independent directors while FCMB has seven as independent directors. Zenith Bank had 54.55 per cent of its board size as non-executive directors with seven as independent directors; Fidelity Bank had 57.14 per cent non-executive directors that included two independent directors; Unity Bank had 66.67 per cent with two independent directors.

Similarly, Union Bank had 64.71 per cent of its board size as non-executive directors, while Diamond Bank and Sterling Bank had 62.50 per cent and 60 per cent non-executive directors on their boards respectively. Wema Bank’s board comprised 58.33 per cent non-executive directors with two independent directors; GT Bank, 53.85 per cent with 4 independent directors; Access Bank, 53.85 per cent with 2 independent directors, and UBA, 52.63 per cent with 3 independent directors.

Our study showed that the boards of all the banks that we reviewed met at least once a quarter (4 times) in 2016 to effectively perform its oversight function and monitor management’s performance. In particular, all the directors of Stanbic IBTC, UBA, Wema Bank, FBN, Diamond Bank, GT Bank, Zenith Bank and Access Bank met the 67 per cent attendance requirement.

However, a director each at Unity Bank and Sterling Bank violated this requirement, while two directors each in Union Bank, FCMB and Fidelity Bank did not comply with the requirement. Three of the directors of Ecobank recorded less than the required 67 per cent board meetings’ attendance.

Source: Banks’ Financial Report 2016, BRIU (Directors who were appointed or who resigned/retired were also included)

Stanbic IBTC, Unity Bank, Wema Bank, FBN and Sterling Bank all had 100 per cent independent directors’ board meeting attendance within the period under review. Others with 100 percent attendance include GT Bank, Access Bank and Fidelity Bank. Zenith Bank had 90.01 per cent attendance; UBA had 95.23 per cent, Diamond Bank had 83.30 per cent and Ecobank 73.79 per cent. Union Bank and FCMBs’ Independent Directors names were not specified.

All banks listed had risk and audit board committees, either as separate committees or fused into one committee. The board committee, audit board committee, risk and audit board committee for all banks reviewed have the least size comprising 4 members.

Stanbic IBTC, Sterling Bank and Zenith Bank all had 100 per cent attendance at the board risk committee (BRC) meeting; Unity Bank had 96.88 per cent, while UBA had 96.67 per cent. Diamond Bank had 92.86 per cent attendance; GT Bank, 90.90 per cent; and Fidelity Bank, 87.51 per cent. Union Bank and Ecobank had 75.03 per cent and 85.71 per cent attendance respectively.

Ecobank, Fidelity Bank and Zenith Bank had 100 per cent attendance at the Board Audit Committee’s (BAC) meeting, and UBA had 96.67 percent attendance. Access Bank achieved 96.66 per cent board attendance; Stanbic IBTC witnessed 94.33 per cent attendance; Unity Bank, 94.28 percent, and Sterling Bank, 93.33 per cent. Similarly, Diamond Bank achieved 87.50 per cent BAC attendance just as GT Bank recorded 85.71 per cent attendance. Union Bank had 60.99 per cent attendance for its BAC’s meetings.

Fidelity Bank, FBN and Zenith Bank had 100 per cent attendance at the board risk and audit committee’s (BRAC) meeting; Wema Bank had 96.88 per cent, FCMB has 96 percent and Diamond Bank has 77.78 percent.

Commenting further, Femi said Nigerian organisations to large extent have started adopting principles in the Code of Corporate Governance. But he insisted that some organisations have not reached the minimum standards for this code stressing that the issue of separation of power where the duties of the chairman and the managing director are fused with lesser independent directors on board of directors are highly dominant.

According to him, the financial services sub sector complies the most with this code because the sector is highly regulated and the regulators ensure strict adherence to the principles of corporate governance.