Nigeria bleeds as NNPC’s under recovery claims grew 600% in six months

A BusinessDay investigation reveals that NNPC’s petrol import under recovery claims grew by over 600% between November 2017 and June 2018, which experts say cannot be traced to any logical increase in consumption of petrol and raises questions about good governance risks posed by the corporation’s sole right to withhold the claims it calls under recoveries, writes ISAAC ANYAOGU.

The smouldering fire from the makeshift incinerator exuded gray fumes strong enough to induce vomiting. Upon closer inspection, the three-foot, five meters wide concrete incinerator contained a jumble of discarded injection kits, tubes and all kinds of medical waste.

But this is not in a discarded landfill; it is the rear entrance of Likosi Primary Healthcare Centre located in Simawa community, in Sagamu, Ogun State, south western Nigeria and home to over 250,000 people.

The Nigerian National Petroleum Corporation (NNPC) donated the facility in 2011 to serve 30,000 people around the community. But the crumbling building mirrors the quality of the healthcare it provides.

Peeling paint, mold forming graffiti on the brackish walls, broken ceilings, and cracked walls. The toilets seemed to dare you to use them. What passes for a pharmacy is a 12 by 12 room,holding a wooden bench with a sparse collection of paracetamols and aspirins.

Healthcare centre matron Oluwaseun Akinsanya said only one doctor makes the rounds in the four primary healthcare centres in Simawa. Residents say the best medical advice is not to get sick enough and to avoid the facility all together.

“We performed the last delivery only two days ago using light from our mobile phones,” Akinsanya said.

Likosi Primary Health Care Centre is one of many facilities that cannot provide the services it was built to, according to a report by non-profit organization Christain Aid. During recent budget presentations Nigerian state governors said they could not fund more hospitals and pay teachers.

One of the governors principal lamentations? Insufficient federal allocations from Nigerian oil sales. The federating units comprising Nigeria share proceeds of oil sales handled by the NNPC but these allocations have been on the decline. The states who generate poor revenues depend on this allocation. In June this year, the governors walked out on a Federal Accounts Allocation Commitee (FAAC) meeting of finance commissioners convened to share allocations because N20bn was allegedly withheld by the NNPC.

“NNPC owes a duty to Nigerians in the spirit of openness and transparency to be open and transparent to all stakeholders…,” Mamood Yunusa, chairman of the Finance Commissioners Forum, told journalists after the impasse.

The NNPC counters that it is not withholding more than it should, but said the the cost of providing cheap petrol erodes revenue.

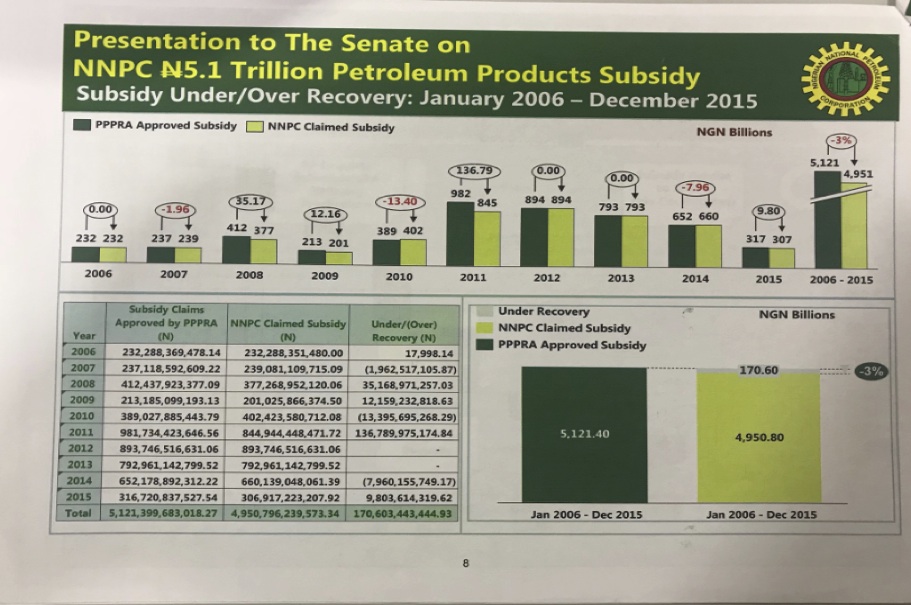

The corporation told lawmakers during a probe in January that the Federal Government owes it N170.6 billion in subsidy payments due from January 2006 to December, 2015.

Less than six months after the retail price of petrol was pegged at N145 per litre in May 2016, oil prices rose above $50 per barrel (bb/l) from $40 bb/l. Oil marketers stopped importation because their was no provision to subsidize the cost of importation and NNPC became the sole importer of petrol in the country.

NNPC terms the difference between actual cost of petrol and the control price at the pump as “under recovery” and reports it in its monthly financial and operational report published on its website. Since the government stopped budgetary allocations for subsidy on fuel imports in the 2016 budget, the corporation has been reeling.

Scary reality

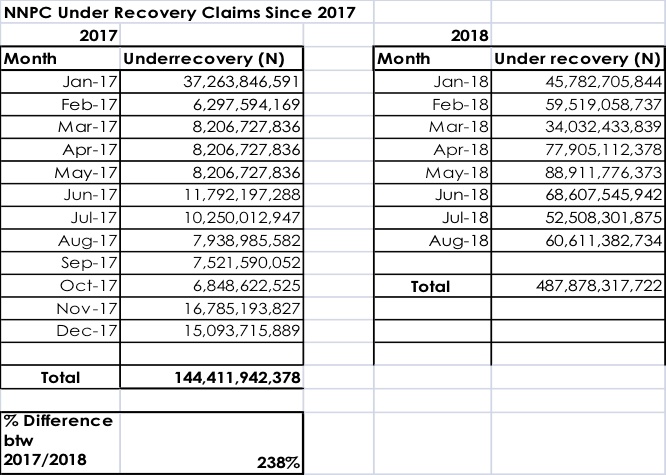

An NNPC document presented to the Senate during a January 2018 subsidy probe exclusively obtained by BusinessDay shows that between 2006 – 2015, the NNPC claimed N170.6billion as under recoveries in ten years while it claimed N632.2billion in two years alone (2017 and 2018), a 217% percentage difference.

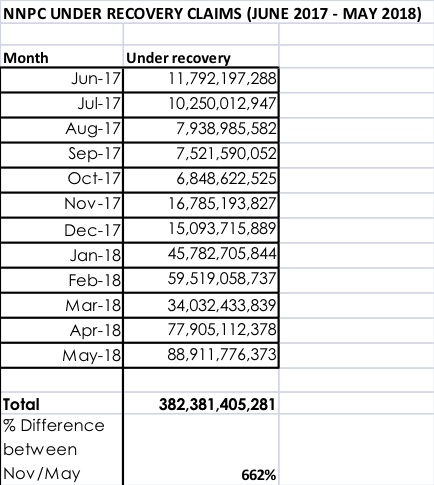

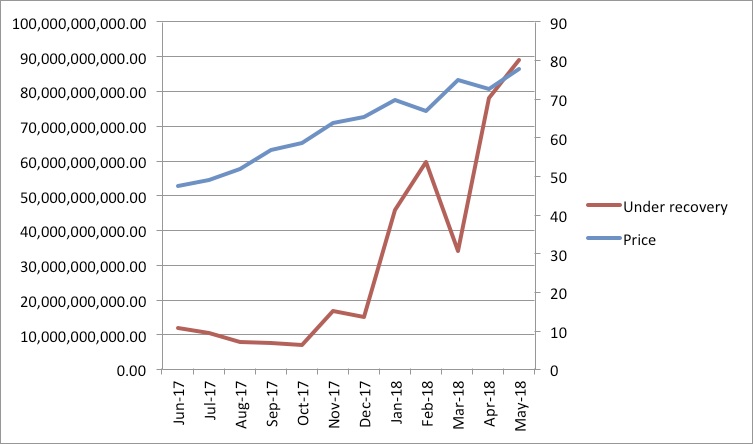

Between November 2017 and May 2018, claims rose by 662% when compared to June and October 2017, according to BusinessDay analysis of NNPC under recovery claims presented in its monthly operations and financial reports published since August 2015.

The NNPC said in December last year that under recovery claims are rising because oil prices have increased but experts disagree about the extent of this increase.

BusinessDay made repeated requests for comment on the analysis and this investigation but the Corporation did not respond.

“It is true that there has been a steady increase in the price of crude oil at the international market for some time now,” Jean Balouga, economics professor at the University of Lagos, said. “Nevertheless it should be remembered that the template NNPC is using for the computation of subsidies (which the NNPC calls under-recoveries) has been queried over and over again.”

“I find no justification whatsoever for the increase in NNPC’S PMS claims” said Balouga who was asked to respond to BusinessDay’s analysis of NNPC under recovery data. Balouga said the claims have been ‘grossly exaggerated.’

NNPC also said that its under recovery claims are rising because it is supplying more fuel as the supplier of last resort. But there is a wide disparity between NNPC’s recent under recovery witholdings with the amounts of fuel it claims it sold.

NNPC’s data also indicate a growing gulf between its reported figures for the petrol it supplies to the domestic market each month against the petrol it claims to have sold, with supply far outstripping sales in recent months.

NNPC’s explains that it is storing some of its imported fuel in tanks rather than selling all and that smuggling accounts for the bulk of the gap.

“NNPC’s depots across the country, including the private ones engaged by the corporation on throughput basis, have an abundance of petroleum products to meet the needs of Nigerians,” the corporation said in September 26 press release.

Interrogating smuggling claims

The NNPC said in March that smuggling of petrol products have led to abnormal rise petrol import from less than 35 million litres to more than 60 milion litres daily.

Maikanti Baru, NNPC group managing director said that 16 statesaccount for 2,201 registered fuel stations. The fuel tanks, he noted, had a combined capacity of 144, 998, 700 litres of petrol.

Eight states with coastal border communities spread across 24 LGAs amongst the states account for 866 registered fuel outlets with combined petrol tank capacity of 73, 443, 086 litres, according to Baru.

The difference in petrol prices between Nigeria (N145 per litre) and neighboring countries (N350 per litre) makes it lucrative for smugglers to use frontier stations to smuggle products across the border, Baru said.

Since smuggling activities have been well documented in the Southern borders, BusinessDay correspondent undertook a visit to one of the so-called notorious Nigerian border in illela, Sokoto to understand how much of Nigeria’s fuel is really smuggled.

Acting as someone trying to enter the smuggling business, BusinessDay reporter established contacts within the three days spent in the community and gathered that while filling stations were springing up around border communities including Nura Kure and Baharazawa International within a five kilometre radius of the border , they rarely get adequate supply.

“Fuel does not come every day,” said a young attendant at Nura Kure who gave his name as Mohammed “Sometimes we don’t get supply for weeks.”

To enter the trade, one needed to be known by the Customs officers. It is better to be affiliated with someone who could teach tfhe tricks and secure an off-taker. Then one can begin moving his merchandise, bribing officials and he is in the business, three people farmiliar with the activities told BusinessDay

Six persons familiar with the smuggling activityconfirmed that the operation is largely rudimentary.Petrol is moved in carts, storage compartments built under trucks and modified fuel tanks of saloon cars to carry over 80 litres of petrol they said.

“I have been carrying petrol across the border for a long time,” a motorcycle operator who gave his name as Hassan, said. “It is not difficult,” he assured. “I bribe the Customs and I move on.”

In the three days spent around illela, BusinessDay estimated shipments of between 12,000 and 20,000 litres of fuel across the border. Two cart pushes lugging 20 pieces of 25-litre jerry cans twice across the border a day could move 6,000 litres. Five trucks bearing 4 pieces of 25-litre jerry can across the border over three days can deliver 1,500 litres. While seven saloon cars with a capacity to lift 80 litres making three rounds a day, within three days delivered about 5,040 litres of fuel.

Though the investigation was limited to the day due to security concerns, BusinessDay understands that smuggling activities go on at night but without trucks.

Using the NNPC’s monthly report as basis for analysis, to move the volume of petrol the NNPC is ascribing to smuggling will entail a large-scale operation involving over 750 trucks with 33,000 litre capacity to convey over 25million litres of petrol daily out of Nigeria.

“If that much trucks were diverted from NNPC’s operations, clearly Nigeria will feel the pinch,” Olumide Adeosun, PwC Nigeria’s head of energy research said by phone.

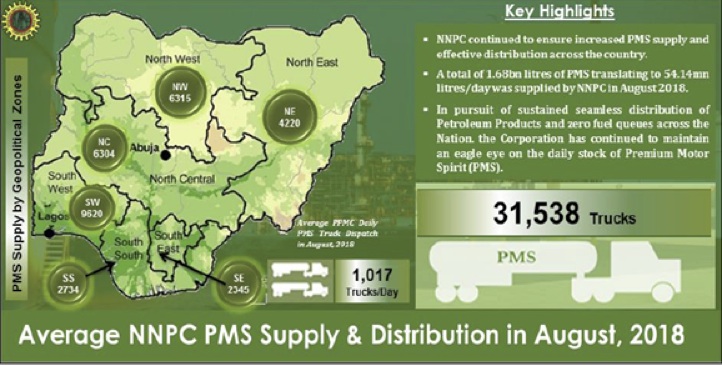

According to NNPC’s August operations and financial report, the Nigerian petrol trucking is undertaken by 1,017 trucks daily. The entire month sees 31,538 trucking operations . Taking 750 trucks daily outside the borders will not only leave a yawning gap but will question the existence of the Nigerian Custom Service.

Jerry Attah, spokesperson for the Nigerian Customs when contacted for comments, said proliferation of licensed filling stations at border communities is encouraging artisanal smuggling of petrol outside Nigeria.

But when confronted with accusations that Customs officer were enabling the practice, Attah said, “Customs cannot stop a car to measure their tanks least we are accused of being overbearing.

“We can’t check everything on people or their houses but,no truck can be allowed to move petrol across the borders with fuel,” Attah said. “The bigger picture is reviewing the licenses of these filling stations.”

Subsidy – a cat with many lives

Successive administrations in Nigeria since 1999 have elected to keep the petrol subsidy despite years of abuse and a reported drain on national revenue. Government committees have recommended ending fuel subsidy yet it still in place.

Following the 2011 subsidy scam where Nigeria lost over N2trillion to fraudulent oil marketers who collected money for fuel they did not deliver, a presidential committee was established to probe the allegations.

The probe, headed by former managing director of Access Bank, Aigboje Aig-Imoukhuede, recommended a complete deregulation of the downstream petroleum sector.

In 2012, Nuhu Ribadu, a former chairman of the Economic and Financial Crimes Commission was tasked to head a committee to review NNPC’s operations. An excerpt of his report reads:

”In the course of the Task Force work, we did not receive sufficient justification and basis for the practice of deducting subsidies from the amounts payable to the Federation Account. Indeed this practice does not accord with the law, with particular reference to the Constitution.”

The Ribadu report found that as its debt position worsened after 2009, NNPC also began using the non-refined portion of the domestic crude allocation in costly ways:

“Withholding proceeds from sales of exported domestic crude oil: This practice began ostensibly to cover fuel subsidy costs. NNPC itself has denied this publicly, but our findings shows NNPC withheld N1.983trillion in subsidies between 2006 and 2011.

“PPMC values the products stolen from its pipeline network between 2001 and 2010 at N178 billion. It is alleged that when products are stolen at ports and jetties, inspectors sign discharge sheets for the full landing amount, which allows importers to collect fuel subsidy on stolen products,” the report said.

“Nigeria has to decide what it must do with fuel subsidy, because we can’t go on like this,” said Adeola Adenikinju, a professor of energy economics at the Federal Unversity Ibadan and current member of the Central Bank Monetry Policy Commitee.

Balouga recommends a pragmatic approach. “Let’s start with overhauling the template, checking the prices and knowing exactly the daily PMS consumption in Nigeria, before any other thing.

Balouga further recommended a phased approach to reforms. “Let the refineries be fixed and let their capacity utilization climb to at least 90 percent; let Dangote refinery and petrochemicals come on stream; let per capita income climb to a reasonable level; let unemployment reduce drastically; let there be a strong regulatory framework as well as strong institutions. Then, if necessary, deregulation.”