Affordable housing, public transportation as essential aspects of impact investing

The age of entrepreneurial capitalism saw a simultaneous growth in capital and inequality as well as poverty everywhere. These super-wealthy entrepreneurs, concerned as they are, are now looking for areas of high impact and need to redirect capital towards sustainable co-existence. Impact investing is a portmanteaux term that captures the genuine intention to release private capital in compliment to public resources and charities in addressing pressing global challenges. According to the Global Impact Investing Network (GIIN), Impact investing focuses on investments made with the intention to generate positive, measurable social and environmental impact alongside a financial return.

The philosophy of impact investing derives from the tenets of sustainable development, adopting the three basic principles of social, environmental and economic/financial consideration. The growing impact investment market provides capital to address the world’s most pressing challenges in sectors such as sustainable agriculture, renewable energy, conservation, microfinance, and affordable and accessible basic services including housing, healthcare, and education.

In Nigeria, where impact investing is still in its infancy in terms of investor-participation, operation and awareness, it seems to be getting off under a somewhat narrow outlook and/or definition. For instance, beside those who still think of impact investing as some form of modified philanthropy, the problem is mainly in its imminent circumscription to certain sectors as financial technology (FinTech), agricultural technology (AgTech), waste management, and renewable energy. There are particularly for Nigeria, broad other areas of impact such as in developing affordable housing models and mass transportation service.

Affordable housing

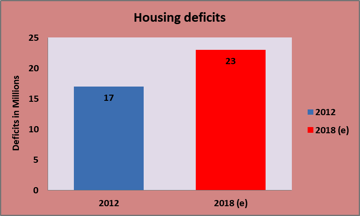

As at 2012, the level of housing deficit in Nigeria was already 17 million units. Some reports state that it would take the production of one million units per annum over a 20-year period to close this gap. However, overall annual production of housing is about 100,000 units which imply a corresponding deficit of 900,000 units – going by the one million units per annum benchmark – which carries a potential cost of US$ 16 million. But two important things have happened in the recent past: the National Bureau of Statistics estimated the population of Nigeria to have increased to about 198 million people, of which 87 million live below the standard poverty threshold of less than 2 dollars per day. Intuitively, if population and poverty levels have increased, and there is no commiserate rise in the provision of housing units, then the number of people out of homes must have increased and the deficit in housing, worsened.

fact, evidence abounds that housing models are typically luxurious and market based; and efforts on urban renewal continues to be towards gentrification of communities, skewed against the poor and even the regular working-class individuals. Arguably therefore, while population and poverty levels have increased since 2012, the same cannot be said for the provision of affordable housing for low-income earners. Going by the estimated annual deficits, total housing deficit would be in the corridors of 23-25 million units conservatively.

The high capital-output ratio in housing investments implies that unchecked markets would not yield socially optimum outcome. Housing is a major part of household consumption and savings motives in developing countries. Therefore, improving housing conditions would have positive implications for the standard of living and it is critical for city development and urban planning. Consequently, it is very necessary therefore to explore this area of need for impact investments.

At the inaugural event of the Alliance of Impact Investing in Nigeria, it was Roy Swan, Director for Mission Investments at the Ford Foundation who mentioned about the housing projects executed in the United States and progress made thus far. A 2017 report by the Heinrich Boell Stiftung in Nigeria (HBS) and Arctic Infrastructure also outlined different strategies towards achieving affordable housing in urban Lagos. The report also exemplified two international case studies in Maryland, USA and Vienna, Austria as guide for mixed housing strategies.

It is important to have stakeholder engagement on housing strategies; governments would have to be more involved by creating the proper incentives for social entrepreneurs and community developers to take up interests in social housing.

Public transportation service

Public transport system in Nigeria is one of the least efficient sectors in the economy. However deregulated the sector is, it is an all-comers’ affair: there are no rules of the game, no standards or minimum requirements, no quality service delivery, no consumer rights, little or no corporate players, just individuals who own mainly rickety buses – and commercial motorcyclists. The total number of road crashes reported according to the Nigerian Bureau of Statistics (NBS) in the second quarter 2018 stood at 2,608 crashes. Speed violations, burst tyres and dangerous driving accounted for 50.65 percent, 8.59 percent, and 8.40 percent of the total crashes respectively. This implies the preponderance of grossly undertrained drivers.

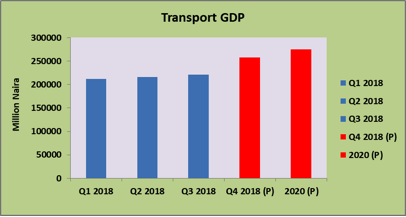

Nonetheless, it is a huge market with potential for efficiency and expansion. According to Trading Economics (TE), transport contribution to GDP was estimated at N221.41 billion as at Q3 2018 (Q2 2018: N216.35 billion). The projection for the year end is estimated to reach N257.89 billion and N274.92 billion in 2020. The average contribution to GDP from 2010 to2017 was N193.8 billion, with an all-time high of N253.33 billion in Q4 2017. The number of commercial vehicles at 6.8 million account for 57.70 percent of the total vehicles.

That said, under the right design and incentive framework, the transport sector can exceed projections. The government however need only set the rules and policy incentive for private investments to swing in. We have seen the impact of disruptive innovation such as Uber and Taxify in the taxi space. I believe that commuters, over time, would correctly revalue their preferences leaning towards service delivery against the current inefficient system – which would be competed out.

Conclusion

As impact investing continues to gain credence in among corporate Nigerian and investors, it is important to adapt it to the most pressing problems plaguing the society, however without any form of narrow definition about its scope. The essence is to avoid copious application of the term as found in other climes irrespective of our own peculiarities. Other vital areas for impact investing include health and education sectors where there are widespread inefficiencies due to poor infrastructure and investments.