Sustainable housing reforms set to bridge housing deficit in Nigeria

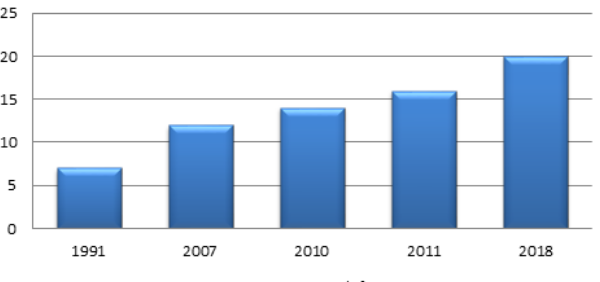

Globally, there is a strong consensus that the development of the housing sector is essential for stimulating economic growth. Housing construction is one of the frequently used indices for measuring economic conditions worldwide. However, recent reforms in the mortgage industry is set to bring sustainable growth in the industry and bridge the housing deficit, which is estimated at20 million.

Different measures had been put together by the government and organised private sector to create an enabling environment where housing will be made affordable and available to Nigerians at a relatively low-cost price. Consequently, numbers of factors have contributed to the rise in housing deficit, and the factors include a growing population. According to United Nations, Nigeria’s population stood at 196,189,141 as at 29 July 2018, with a growth rate of 2.61 per cent in the first half of 2018.

Urban population is 51.0 per cent, which implies that 99, 967, 871 people are residing in the Urban cities in Nigeria. The population growth has exertedsignificant pressure on the housing demand and deficit.

Acquisition of housing through mortgage financing still remains a major impediment, hence, there is an urgent need to review the legal framework on which the industry is built, especially, the cost of perfecting a title and transaction cost. For instance, the cost of registering a property has immense effect on the cost of housing in Nigeria making it more expensive to access housing or landed property.

Housing delivery is subdued by limited access to finance, short mortgage tenors, slow legal procedures, and the high cost of land registration and titling. Particularly, the ownership rights under the Land Use Act (1978) vests the ownership of all land to state governments.

The huge housing deficit in the country signifies good prospects for the mortgage industry.The housing gap can also create employment opportunities, especially in the course of trying to bridge the housing deficit.

Mortgages can also promote the use of the mortgage insurance; embed risk management; develop the secondary market; standardize the process of mortgage underwriting; and encourage capacity building and professional development

In the quest of addressing the country’s housing deficit, the Primary Mortgage Bank (PMB’s) came together to establish Mortgage Warehousing Fund Limited (MWFL), this is a special purpose company set to provide short term funding to its owner – mortgage banks in Nigeria, through the establishment of a multi – seller asset – backed commercial Paper Programme (CP), this programme provides short term liquidity by pre-financing Eligible Mortgage Loans (EWL’s) originated by MWFL’s member mortgage banks and accredited and licensed mortgage institutions.

Source: CBN Occasional Journal

Mortgage Warehousing Fund Limited (MWFL) Pre-financing Process

According to the information gathered from MWFL, participating member Mortgage Bank (MMBs) assess prospective homeowners and book mortgage loans they intend to fund in advance of closing such mortgage loans. The process of conducting an assessment of the loans will run up to a cut – off date which is the end of the origination period in line with the applicable MWFL Prefinancing timeline for the specific round of funding.

After aggregating the principal sum of all loans booked, the participating MMBs will send a request for prefinancing to MWFLs. MWFL will fund a maximum of 80 per cent of the aggregate loan amount booked ( or a maximum of 64 per cent of the property value) pursuant to the Master Purchase, prefinancing and Servicing Agreement (MPPSA).

All submissions of funding requests must be supported by all relevant pre – funding documentation for each mortgage loan booked in the proposed mortgage pool. The participating MMBs will also submit a Mortgage Factsheet which will contain details of the mortgagor and the mortgaged property along with an executed undertaking in respect of the information provided in the Mortgagor Factsheet which will indicate that each criterion under the NMRC Uniform Underwriting Standards has been complied with in creating each of the mortgage loans in the submitted portfolio.

Upon receipt of pre-funding documents from all participating MMBs, MWFL will review the Mortgagor Factsheets and all the pre-funding documents submitted for conformity with the NMRC UUS. Upon satisfactory review of all required pre-funding documents, MWFL will issue qualifying MMBs with conditional approval of the funding request. MWFL will also conduct site visitation on randomly selected properties to be prefinanced from time to time.

Whilst still conducting its review of the pre-funding documents received from the participating MMBs, MWFL will forward the documents to NMRC for their review and subsequent approval. NMRC has sixty (60) working days to review the mortgage portfolio documents and approve same. Any non-conforming loans within the pool (if any) will be identified and sent to the relevant MMBs to substitute affected the loan(s) with eligible loan(s).

MWFL issues Commercial Papers (CPs) to money market investors equal to the aggregate funding request amount of the participating MMBs in the applicable prefinancing round. Upon the successful CP issuance, MWFL will provide all participating MMBs with their respective funding requests after all conditions precedent to prefinancing have been met, and all required pre-financing loan documentation have been completed, submitted, reviewed, and found acceptable. All prefinancing facilities provided by MWFL will be in strict adherence to its collateralisation policy as contained in both the MPPSA and MWFL Credit Policy Manual.

Upon receipt of the funding from MWFL, each participating MMB will close all the prequalified Eligible Mortgage Loans, after which all post-funding documents as required in accordance with the MPPSA are sent to MWFL. Both MWFL and the participating MMBs will assemble all post-prefinancing documentation in respect of the eligible mortgage loan portfolio and deliver to NMRC within 14 days post-prefinancing, for commencement of final due diligence in readiness for refinancing at the end of the minimum six (6) month seasoning period.

NIGERIA MORTGAGE REINANCING COMPANY (NMRC) UNIFORM UNDERWRITING STANDARD(UUS)

The Uniform Underwriting Standards outlines the standards under which a mortgage loan underwritten by a member mortgage lending institution of the NMRC will be eligible for refinancing by the NMRC.

The goal of the NMRC Uniform Underwriting Standards is to:

- Promulgate mortgage lending standards and procedures within the Nigerian mortgage market, thereby facilitating improved access to housing finance; and

- Develop and promulgate the criteria for acceptable prime mortgage loans, including payment performance, financial terms, legal contract terms, mortgage loan product designs, mortgage loan underwriting criteria, and the contents of mortgage loan documents.

Lending standards promote efficiency and mitigate the legal and operational risks inherent in mortgage lending by ensuring quality collateral, adequate property title, proper registration, enforcement of legal mortgages, and maintenance of efficient collection processes.

The following primary mortgage banks constitute the current membership of MWFL:Abbey Mortgage Bank Plc, Brent Mortgage Bank Limited, Homebase Mortgage Bank Limited, Imperial Homes Mortgage Bank, Jubilee Life Mortgage Bank Limited, Lagos Building investment Company Limited, Mayfresh Mortgage Bank limited and Trustbond Mortgage Bank Plc.