How capital importation is boosting African economies

Portfolio investment is an aspect of international capital flows of financial assets comprising cash, stocks or bonds across international frontiers in want of profit. This type of investment has become an increasing part of the world economy over the past decades, and also a significant source of investment funds not only in developed countries, but in the developing economy. In Nigeria, it has reached an essential level in the Nigerian capital market as it accounts for not less than two-thirds of the capital inflows in the last two quarters of 2018.

Investment inflows into the Nigerian economy in the first six months of 2018 shows investors’ risk preferences and opportunities across different segments or sectors. Portfolio investment, which is one of the sources of funding for different investment opportunities, accounted for 74.7 per cent of the total capital imported into the Nigerian economy in the first six months of 2018. This is equivalent to N1, 261.1 trillion when expressed at official exchange rate of N306.15 to the US dollar. Portfolio investment has grown recently in higher proportion relative to other types of capital inflows into Nigeria over the years.

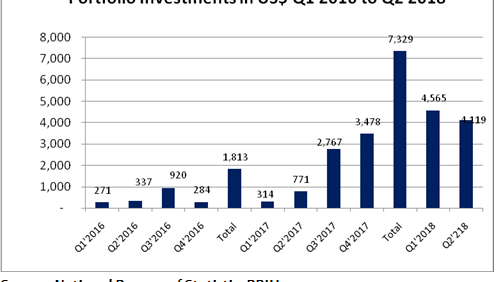

While the absolute value declined in the second quarter of 2018 especially when analysed on a quarterly basis, falling from $4,565.09 million in Q1, 2018 to $4,119.46 million in Q2, 2018, portfolio investment remained the largest constituent of the total capital importation, data sourced from the National Bureau of Statistic (NBS) and analysed by BusinessDay Research and Intelligent Unit (BRIU), has shown.

On year on year basis, the total value of portfolio investment in Q2 2018 which was $4,119.46 million rose by 434.64 per cent from $770.51 million imported in Q2, 2017.

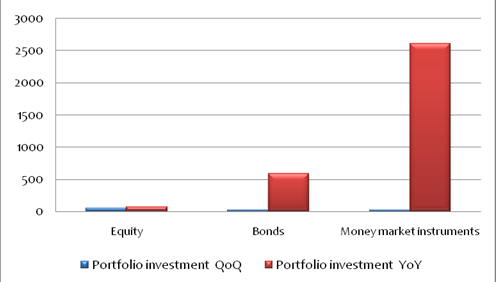

The 9.76 per cent quarter on quarter decline was due to a fall in the largest sub-component of portfolio investment which was money market instruments. In both the first and second quarters of 2018, money market instrument was the largest component of portfolio investment just as other components include bonds and equity.

Capital importation in the form of money market instruments stood at $2,670.93 million in the second quarter, representing a 24.29 percent decrease over the previous quarter. Investments in both equity and bonds under portfolio investments recorded steady quarter-on-quarter growth, to the tune of 49.43 percent and 19.13 percent respectively. It is worth noting that investments in bonds that came into the country in the form of capital importation have been steadily increasing since Q2, 2017. In Q2 2018, it accounted for 9.71 percent of total portfolio investment.

Source: National Bureau of Statistic, BRIU

Source: National Bureau of Statistic, BRIU

Furthermore, portfolio investment maintained a prominent position in 2017 (year on year), with additional $5,516.18, over its level in 2016. In the first quarter of 2018, portfolio investment level was $4,565.09, but declined by $445.63 in Q2 of 2018.

As capital importation into the Nigerian economy fluctuated in recent times, emerging countries in West, East, Central and Southern African economic blocs witnessed the same trend. Results showed that Kenya’s foreign portfolio investment fell by $109.84 million in December 2017, compared with an increase of $39.90 million in the previous year.

According to the Kenya Bureau of Statistic in their latest report, the country experienced a decline to the tune of $315.00 million in December 2017 in portfolio investment, while its foreign direct investment increased by $671.49 million in the same year, just as its direct investments abroad have an upward movement of $257.09 million in December.

Ghana’s long run portfolio investment from 1998 through 2017 has been on steady decrease, in 2017, net portfolio investment reduced by $2,536 million, according to Ghana bureau of statistic report.

In first quarter of 2018, South Africa’s foreign portfolio investment recorded an increase amounting to $7.48 billion in March 2018, when compared with an increase of $6.93 billion in the previous quarter. According to data gather by BRIU from CEIC, a data company from their web platform, it shows that South Africa current account segment recorded a deficit to the tune of $4.79 billion in March 2018.

Essentially, growth in foreign portfolio impact could impact positively on the economy by providing financial resources for investment in key areas like infrastructure, agriculture, solid minerals, manufacturing, banking and other financial services. FPI can provide the needed resource to the government and corporate organisation in Nigeria through the bond market for infrastructural and industrial productivity.

The foreign portfolio investment in bond market could either be invested in government bonds or corporate bonds. If invested in government bonds, the proceeds would be used for financing infrastructural facilities that are so much needed in Nigeria while if invested in corporate bonds, the proceeds would be used to finance business projects that will enhance the profitability of the corporation without putting any hurt on the cash flows of the corporation compared to when the projects are financed by bank loans which usually have a high cost of capital.