Lack of competitiveness,low yield put Nigeria in a back seat in global cassava export

Cassava is one of the major foods found in South America, Africa, and Asia. In particular, Africa produces more than 50 percent of the total world’s cassava, 30 percent in Asia and about 10percent are grown in Latin America with Nigeria, Thailand, Brazil, Indonesia and Ghana being the top five major global producers of the produce according to the 2017 data from the Food and Agriculture Organisation (FAO).

Cassava value chain ranges from raw materials (cassava fresh roots) to the primary processing (African food processing, flour, chips, crude ethanol and native starch production), secondary processing (flour baking, pellets, final distillation of ethanol, textile, pharmaceuticals, paper and wood) and the market (garri, fufu, bread, candles, cakes, ice-cream, animal feed, fuel ethanol, beverages, soups, garment, pills, furniture etc.).

From early 1960s to late 1970s, Nigeria ranked the world’s fourth major cassava producer after Brazil, Indonesia and the Democratic Republic of Congo. In 1980, Nigeria dropped to the world’s fifth largest cassava producer through 1988 and rose back to the fourth position in 1989. In 1990, Nigeria became the world’s third cassava producing country. However, from 1991 till date, Nigeria’s total world cassava production increased substantially replacing Brazil as the leading cassava producing country globally, with more than 50 million metric tonnes of cassava produced annually from a cultivated area of about 3.7 million hectares.

This rise in cassava production in Nigeria could be attributed to high demand for food due to rapid population growth, increased poverty and hunger. Expansion in cassava production is also due to expanded genetic research and improved agronomic practices towards cassava yields according to FAO.

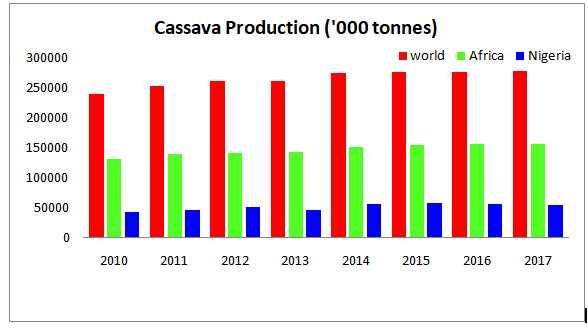

Nigeria,according to data gathered by BusinessDay Research and Intelligence Unit (BRIU) from FAO,accounts for about 20 percentof the total world’s cassava production, 34 percentof Africa’s production and 46 percentof West Africa’s production. About 66 percentof total Nigeria’s cassava production is in the southern part of the country, with the north central accounting for 30 percentwhile the other parts of the north make up 4 percent.

Nigeria’s estimated total cassava production in 2010 stood at 42.5 milliontonnes which increased to 46.1 million tonnes in 2011. In 2012, cassava production in Nigeria increased to 50.9 million tonnes but declined to 47.4 million tonnes in 2013. Production rose in 2014 from 56.3 million tonnes (due to preferential loans to producers, grants to processors for the expanded uptake of domestic cassava, as well as the continued propagation of improved varieties) to 57.6 million tonnes in 2015 and fell to 57.1 million tonnes in 2016.

Source: FAO, BRIU

In 2017 however, cassava production in Nigeria was forecast to fall further to 55 million tonnes. The 2017 decline of cassava production from 2016 was due to Anchor Borrower’s Programme” (ABP) initiated by the Central Bank of Nigeria that made rice more lucrative to cultivate which led to farmers shifting out of cassava.

Analysts observed that even with high cassava production in Nigeria, itstotal cassava average yield was estimated at about 13.63 tonnes/ha as against its potential yield of about 40 tonnes/ha; a shortfall of 26.37tonnes/ha.

Soji Apampa, chief executive officer of the Convention on Business Integrity in a telephone chat with BRIU said that one of the reasons for the poor yield of cassava was as a result of farmers planting low variety of cassava species which caused low productivity.That necessitated the action of government and the International Institute for Tropical Agriculture (IITA)in providing improved stems with high yield properties for farmers to plant.

“Farmers lack the right fertilizer for the type of soil in Nigeria;right herbicides and pesticidesatthe right quantity are also not being properly used”, Apampa said.

He noted that the knowledge gap of small holder farmers to these issues is very wide, as there are just one government extension worker to about 10,000 farmers. Hence, most farmers never get a visit from the extension workers and therefore never get information on the right things to do. Averagely, most farmers get just seven tonnes/ha but some having been assisted have moved to 22tonnes/ha and more.

“The testimony of a farmer was that for the local variety, they get at most three tubers when they harvest but with this improved variety, they get minimum of 13 tubers from one stem”, he concluded.

It is alarming that Nigeria, even with its high cassava production rate has very low export figure. In 2005 cassava export quantity stood at six thousand metric tonnes and fell to four thousand metric tonnes in 2006. From 2007 through 2009, Nigeria exported eight thousand, 13 thousand and one thousand metric tonnes of cassava respectively. Similarly, two thousand, 13 thousand and one thousand metric tonnes of cassava were exported from 2010 through 2012 while in 2013,Nigeria exported 11 thousand tonnes according to FAO.

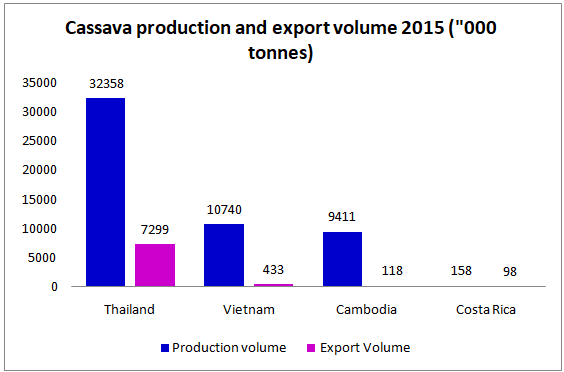

In 2015 according to Index Box, the top exporters of cassava and cassava products were Thailand (7.3 milliontonnes generating $1,539 million), Vietnam (433 thousand tonnes generating $399 million), Cambodia (118thousand tonnes) and Costa Rica (98 thousand tonnes).

Sources: FAO, Index Box, BRIU

In 2016, according to the Observatory of Economic Complexity (OEC), the United States generated $198 million from cassava export; China generated $180 million;Costa Rica $110 million;Laos$65.9 million and Netherlands generated $64.7 million.

On the issue of cassava low export value in Nigeria, Apampa said that the fact that Nigeria is number one in cassava production does not make them same in quality variety production. Most cassava import countries therefore would rather import from countries that are close to them that will give them high quality variety, optimum yield and price/tonne at low transport cost; which makes Nigeria so uncompetitive.

“Nigeria is still leading in cassava production because of the high share of people planting cassava; even though the yield is low, the quantity being planted covers up.Industrial processors of cassava complain of not getting enough cassava but those processing cassava for food find that there are lots of cassavas in the market. This is because industrial processors make use of best quality and variety of cassava which is not what the farmers are planting”, he said.

According to him primary processors who convert cassava to exportable state (ethanol, starch etc.) have difficulty with access to finance,issues of high cost of funds and lack the economies of scales that processors in other countries have. This makes it hard for Nigeria to convert cassava they produce currently into export revenues and keeps the industry from evolving as quickly as they are supposed to.

With the high level of poverty and increasing population in Nigeria, there is great need for a strong, robust and diversified economy that will be able to generate corresponding employment and sustain incomes for the increasing population. The increase in agricultural productivity, industrial capacity utilization, export earnings diversification, employment generation and wealth creation become pertinent.

The public and private sector need to come together to advance ways to enhance cassava competitiveness in the global market.Therefore,there is need to improve know-how of local farmers, educate, encourage and guide them to plant improved varieties and use right inputsby doing demo-plot planting.With that, theywill gradually learn that if productivity is improved without clearing more lands, the unit price of cassava can come down because farmers have higher quality of cassava and processors would be willing to buy more.And also make them understand that although it will cost more to practice all these but since it will yield more, even if they sell at lower price, they will generate more money.